Posted On : April,29,2020Categories: law legal

With more than half of the world pushed back into recession, 2020 seems to be worse than the global financial crisis in 2007-08. With sharp-rise of cases across several countries, the economic damage in these countries would experience a steep increase. Moreover, the International Monetary Fund has predicted that this pandemic would instigate the worst recession since the Great Depression of 1929. As a preventive measure to the upcoming recession, governments have now started pressurizing employers to pay wages to their employees without doing any work.

Indian Government’s Reaction to Prevent Economy Crisis

Initially, a couple of State governments issued orders for a limited period. The governments of Telangana and Delhi in Government Orders dated March 22, invoked EDA to issue lockdown during March 22-31, and directed that this period shall be treated as a paid holiday for all employees in the shops and establishments (for Telangana) and in all the private establishments (Delhi). The government of Maharashtra has ordered (31 March) that all workers (including contract, temporary and daily-wage) in private factories and shops and establishments shall be deemed to be ‘on duty” and be paid full salary and allowances during the lockdown period. On March 29, the Government of India, to effectively implement the lockdown order and to mitigate the economic hardship of the migrant workers issued an order under Section 10(2)(1) of the NDMA. It directed the State governments and the Union Territories (SGs/UTs) to issue orders, compulsorily requiring all the employers in the industrial sector and shops and commercial establishments to pay wages to their workers at their workplaces on the due date without any deduction during their closure due to lockdown. Further, the SGs/UTs were directed to take necessary action against those violating these orders. According to Section 51(b) of the NDMA, non-compliance with the directives issued under it will be punishable with fine and/or imprisonment.

The Indian Government issued an order dated 29th March, 2020 which stated that employers deducting wages of their employees during the lockdown period would be held legally accountable. The national lockdown was clamped by the Home Ministry by invoking the National Disaster Management Act, 2005 along with the Epidemic Diseases Act, 1897. The ministry stressed on the closure of all commercial and private establishments, all transport services, industrial establishments, educational institutions exempting essential services. The Government wants the employers of any kind not to deduct any salaries of their employees during this lockdown period. This article focusses on the legality of this order and how far does this hold good for employers to pay their employees in full without them doing any work.

The ‘No Work, No Pay’ Principle

The Hon’ble Supreme Court in the case of Chief Regional Manager, United India Insurance Company Limited v. Siraj Uddin Khan [Civil Appeal No. 5390 of 2019, decided on 11 July 2019] decided that no employee can claim wages for the period that he/she remained without leave or justification. In the present circumstances, neither the employees offer work nor the workers would be able to report their work. Also, not each and every work be completed through technology and also work from home cannot be thought of as an alternative to the works done at grass-root levels. Therefore, the principle of ‘No work, no pay’ cannot be invoked in the present circumstances. The Government of India order of 29th March focusses on the hardship that would be faced by migrant workers by simply ignoring the fact how hard it can become for employers to pay wages without any work.

Legality of the Order

According to Section 2(vi) of the Payment of Wages Act, 1936, wages means the remuneration payable by the employer to the employee in lieu of the work done. In the present circumstances, when there is no work done by employees, it would become extremely difficult for an employer to pay wages for no work. This payment by an employee would then be considered as a charity and not wages. The Disaster Management Act fails to include provisions relating to the payment of wages, which calls for a reform in the said act.

The first part of GOI notification of 19th March, which is the basis of the order dated 29th March deals with the hardships that are faced by migrant workers and their wages to be paid by their employers, while the second part of the same order also talks about the payment of wages by all employers. When all the circulars and advisories are studied together, it is in no doubt that the government itself looks this as a moral obligation of the employers to fulfill.

Looking at the constitutional validity of the order, under Article 14 of the Indian Constitution, an action without an authority or without a force of law is to be termed as arbitrary and unsustainable. When we look at Section 10(2) of the Disaster Management Act, the government cannot be understood to have capacity to issue such orders. India has various types of industries (large, small, medium, micro), and therefore, a uniform order cannot be laid down. MSMEs would find it almost impossible to fulfill the requirements of the said order. It can be said that ultimately, that these industries are the engines which drive the whole economy of the country. If industries are compelled to pay wages to its employees without the industries not earning any revenue would lead to the collapse of such industries. This can be said to violate the right to carry on business with reasonable restrictions imposed as mentioned under Article 19(1)(g) of the Constitution. It is indeed the duty of the government to look for the employees during such period, and is not the duty of industries to do so.

What Next?

These are fine legal issues which require attention by the lawmakers. The Indian Government would need to come up with a scheme to subsidize employers towards the wages paid during the lockdown. The scheme can be linked to profits earned by the industrial establishment and the wage bill for a month. In the absence of such a scheme, private employers especially small and medium industries will be put through hardships that could even bankrupt them. The government while drawing a stimulus or revival plan for the economy should certainly consider subsiding the wage cost for the lockdown period, if not in entirety, at least in part. If for any reason the government decides to extend the lockdown it should bear the wage burden and should not give any advisory for payment of full wages given it lacks the authority to do so. Maybe, the Govt can advise the establishments to bear/ pay only the necessary amount which is required for subsistence of living or payment of some school fee expenses, which are bare minimum for running the household; which is today being run with zero petrol expenditure, and zero entertainment expenses. Only a proportion of wage expense can be borne by the employers.

Singapore is the first country in the world , launch computer application for trademark Registration , by the easy process you can file your trade mark application within 10 minutes .

A new mobile app touted as the worlds first trademark registration mobile app will allow businesses and entrepreneurs to file their trademarks directly with the Intellectual Property Office of Singapore (IPOS) on their mobile devices.

Named IPOS Go, the app has a simplified user interface and features that will allow for a faster and easier application process, IPOS said.

With the app, a trademark can be filed in less than 10 minutes, a small fraction of the current 45 to 60 minutes IPOS said.

Filing costs will also be significantly reduced as applicants may feel more confident in filing their applications directly with IPOS, the authority said.

Available on the Apple App store and Google Play, the app will also allow applicants to track their registration status, be notified of important updates, as well as file for trademark renewals.

IPOS Go also uses artificial intelligence (AI) technology to help prevent applicants from filing for trademarks that are too similar to existing ones. IPOS said that more than 40 per cent of trademarks filed in the world today contain images.

As the world continues to see a surge in trademarks filings, the new AI capability will help business owners better manage their brands, it said.

According to IPOS, trademark applications in Singapore have increased by 30 per cent over the last five years.

Trademark infringement suit , Texmo Industries inter alia prayed that their mark, TEXMO, be declared as a well-known mark under Section 11 & section 2 (zg ) of the Trade Marks Act, 1999. under sub-sections (6)-(9), this section lays down a number of factors that must be considered before granting well-known status to a mark. however, in this particular case, the issue that was raised, was whether the High Court had the power to declare a mark as well-known.

This question arises primarily due to the text of Section 11(6)-(9), which mentions the Registrar as the authority when determining whether a mark is well-known. It seems, therefore, that the Registrar has the power to determine whether a mark is well-known. However, in practice, courts have declared marks to be well-known , for instance , in the Tata Sons case or Brahmos Aerospace case (covered on the blog here and here).

Court argued that only the Registrar has the power to accord well-known status to marks, but referred the question to a higher bench due to differing views from benches of similar strength. according to the court, the text of Section 11 makes it clear that the Registrar is the proper authority. Further, it stated that the Registrar is more suited to make investigations on this question, since it has the requisite expertise and capability to do so. specifically, the court noted that it cannot give a complete answer for the following factors:

- the extent of knowledge of the mark to, and its recognition by the relevant public,

- the duration of the use of the mark

- the extent of the products and services in relation to which the mark is being used

- the method, frequency, extent and duration of advertising and promotion of the mark

- the geographical extent of the trading area in which the mark is used

- the state of registration of the mark

- the volume of business of the goods or services sold under that mark

- the volume of business of the goods or services sold under that mark

- the nature and extent of the use of same or similar mark

- actual or potential number of persons consuming goods or availing services being sold under that brand

While the Registrar does seem to be well-placed to make a decision on these factors, it would seem that the court is similarly placed in terms of legal expertise and the power to requisition documents and evidence. If these capabilities are the same, then it would be difficult to agree with the court’s practicality argument. Further, if one were to look at Rules 124-126 of the Trademark Rules 2017, and the specifics of Form TM-M (through which applications for well-known status are to be made), the Registrar does not make or have the power to make any special investigation that is beyond the ability of a court. one would also wonder how the renouncing the power to declare marks as well-known to the sole domain of the Registrar would play out in cases where the plaintiff couches their cause of action within the law on well-known marks. would the plaintiff first have to approach the Registry in such circumstances? Further, would the court have the power to hear appeals to the Registrar’s decision in such matters (after following the procedure prescribed in Rule 125 of the Trademark Rules 2017)?

New procedure that allows the Registrar to declare trademarks as ‘well known’. The new Rule 124 allows any trade mark owner to file a request in Form TM-M requesting the Registrar to declare a trademark ‘well-known’. As most of our readers may know, the ‘well-known’ tag is the ‘holy grail’ for trademark owners – everybody wants it but very few will get it.

Once a trademark is declared to be ‘well known’, by a Registrar of Trademarks or a court of law, the Trade Mark Registry is bound under the law to not register any trademark that is identical or similar to the ‘well known’ trademark across all classes of goods and services. Similarly at the time of infringement proceedings, a ‘well known’ trademark can be asserted against defendants dealing in entirely different goods or services. For example, ‘Google’ has been declared a well-known trademark under Indian law, which means nobody else but Alphabet Inc. can register ‘Google’ in any of the other class where it has not already been registered by Alphabet or use ‘Google’ to sell goods or services in any industry and not just the internet industry. The commercial implications of being declared a ‘well known’ trademark are therefore tremendous.

Prior to the enactment of Rule 124, a Registrar or a court of law could declare a trademark well known only during opposition, rectification or infringement proceedings. Rule 124 however creates an entirely new procedure to recognize well known trademarks. This procedure is different from opposition, rectification or infringement proceedings in that the latter are adversarial in nature with both parties presenting evidence to back their claims and the Registrar is required to resolve these conflicting claims through a reasoned order. The trigger for these proceedings is a legal event that is not usually within the control of the trademark owner i.e. it is the alleged infringer or opponent who sets in motion the events leading to the proceedings that can result in a trademark being declared ‘well known’. The new Rule 124 allows the trademark owner to set the ball rolling without requiring any infringement or opposition proceedings. The rule does impose some vague duty to “invite objections from the general public” but this process is fundamentally different from opposition, rectification or infringement proceedings where an opposing party has already asserted its rights against the trademark owner.

The crucial question at this juncture is whether Rule 124 is constitutional? Rules, which are delegated legislation, draw their legitimacy from the parent statute. In this case the Trade Mark Rules, 2017 draw their legitimacy from the Trade Marks Act, 1999. This legislation however does not delegate to the Central Government the power to create an entirely new procedure to recognize well known trademarks. Section 157 of the Act which lays out the rule making power of the Central Government under the Trade Marks Act, 1999 is silent on the issue of well known trademarks. There is a residuary provision in Section 157(xli) that gives the Central Government the power to make rules for “any other matter which is required to be or may be prescribed”. Like all provisions conferring residuary powers, this provision is widely drafted however a residuary provision is still bound by the two most important principles of delegating legislative power: The first principle is that delegated legislation cannot be in conflict with the provisions of the parent legislation. Secondly, an essential legislative function cannot be delegated by Parliament to the Executive – the In re Delhi Lawsjudgment is quite clear on this issue.

The new Rule 124, I would argue, goes against both principles. The rule reflects an entirely new policy to recognize “well-known” trademarks through a procedure that is not an adversarial proceeding (as is the case currently). In fact, the new procedure is in conflict with the adversarial procedure recognized in Section 11 for a trademark to be recognized as well known. Unlike the Section 11 procedure which required an opposition, rectification or infringement proceeding to trigger a adjudication on whether the trademark is well-known, Rule 124 allow a trademark to be recognized as well known by simply making an application to the Registry. The requirement to “invite objection” is fundamentally different from an opposition or rectification hearing because it does not guarantee a right to be heard. This entire procedure is alien to the scheme of the Trade Marks Act, 1999.

The true fear with this new procedure is that it places immense powers in the hands of the Trade Mark Registry, which as we all know is one of the more corrupt agencies in the IPO – we are all aware of Registrar’s Kasturi’s arrest and conviction on charges of corruption. The possibility for abuse of power is ably aided by some rather strange provisions in the Trade Marks Act, 1999. In particular Section 11(9) of the Trade Marks Act makes it clear that the Registrar shall not require as a condition, for determining whether a trade is well-known, any of the following, namely: (i) That the TM has been used in India; (ii) That the TM has been registered; (iii) that the application for registration of the trade mark has been filed in India; (iv) that the trade mark is well known in or registered in any other jurisdiction other than India (v) that the trademark is well-known to the public at large in India. Why should a trade mark be recognized as ‘well known’ in India if it not well known to the public at large? Isn’t that the entire point of being a ‘well-known’ trademark?

Even the affirmative criteria to recognize a trademark as a ‘well-known’ trademark in Section 11(6)(i) goes against the very idea of a ‘well known’ trademark. This provision reads as follows “the knowledge or recognition of that trade mark in the relevant section of the public including knowledge in India obtained as a result of promotion of the trade mark”. Why should the trademark be recognizable only in the “relevant section of the public”? The entire point of granting “well known” trademark such vast protection is that it has attained recognition amongst a large section of the public not just a “relevant section of the public”. These provisions of the Trade Mark Act read like they have been written by a lobbyist and are begging to be amended.

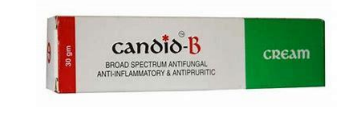

Candid – B Vs. Clodid – B

Observation by Mr. Justice Kathawalla –

“Drugs are not sweets. Pharmaceutical companies which provide medicines for health of the consumers have a special duty of care towards them. These companies, in fact, have a greater responsibility towards the general public. However, nowadays, the corporate and financial goals of such companies cloud the decision of its executives whose decisions are incentivized by profits, more often than not, at the cost of public health. This case is a perfect example of just that.”

Glenmark Pharmaceuticals Ltd. vs. Curetech Skincare and Anr., Mr. Justice Kathawalla of the Bombay High Court imposed costs of 1.5 crores against the defendant found to be ‘habitually’ committing trademark infringement of pharmaceutical products. The decision is significant for the quantum of damages awarded and the reasoning (or lack thereof) behind the award of exemplary costs. The dispute concerns Mumbai-based generics manufacturer Glenmark, and its product Candid – B (an anti-fungal cream). The principal defendant is Galpha Laboratories is the proprietor of a similar drug, selling under the trade name Clodid – B. The two products have similar packaging and trade dress, as made out from the images in the judgement. Having been nabbed for what appears to be obvious infringement, the defendant claimed that the mark was adopted by mistake, and chose not to contest the suit.

Judgement and Order as to Costs Given that the suit was not contested, the defendants submitted to the imposition of costs and prayers preferred by the plaintiff. The manner and rationale for the imposition of costs is important to examine. The Court examined the history of the defendant of committing trademark infringement. In particular, it noted the Delhi High Court’s adverse findings against the defendant in Win-Medicare Pvt. Ltd. Vs. Galpha Laboratories Ltd. & Ors. (covered here), where it noted that Galpha was a ‘habitual offender’.

Further, the Court also examined the defendant’s history of producing substandard drugs, which had been pointed out both by the Central Drugs Standard Control Organisation as well as the Maharashtra Office of the Drug Control Administration. Chastising the defendant for its practices, the Court held that it was a fit case for imposing exemplary costs, despite the fact that the matter was being finally settled in terms of the plaintiff’s prayers, and imposed costs of 1.5 Crores (which the plaintiff generously agreed to be deposited into the CM’s Kerala Flood Relief Fund).

As far as I am aware, this is the largest order of such exemplary costs in a trademark infringement case, and is particularly interesting given the compromise reached between the parties. However, the Court’s order is also notable for its examination of the public interest in preventing such undesirable practices in the pharmaceutical sector in India, which is notorious for rampant trademark malpractice, leading to significant public health concerns due to spurious drugs, something that has been repeatedly stressed by courts when assessing pharma trademark cases.

New procedure that allows the Registrar to declare trademarks as ‘well known’. The new Rule 124 allows any trade mark owner to file a request in Form TM-M requesting the Registrar to declare a trademark ‘well-known’. As most of our readers may know, the ‘well-known’ tag is the ‘holy grail’ for trademark owners – everybody wants it but very few will get it.

Once a trademark is declared to be ‘well known’, by a Registrar of Trademarks or a court of law, the Trade Mark Registry is bound under the law to not register any trademark that is identical or similar to the ‘well known’ trademark across all classes of goods and services. Similarly at the time of infringement proceedings, a ‘well known’ trademark can be asserted against defendants dealing in entirely different goods or services. For example, ‘Google’ has been declared a well-known trademark under Indian law, which means nobody else but Alphabet Inc. can register ‘Google’ in any of the other class where it has not already been registered by Alphabet or use ‘Google’ to sell goods or services in any industry and not just the internet industry. The commercial implications of being declared a ‘well known’ trademark are therefore tremendous.

Prior to the enactment of Rule 124, a Registrar or a court of law could declare a trademark well known only during opposition, rectification or infringement proceedings. Rule 124 however creates an entirely new procedure to recognize well known trademarks. This procedure is different from opposition, rectification or infringement proceedings in that the latter are adversarial in nature with both parties presenting evidence to back their claims and the Registrar is required to resolve these conflicting claims through a reasoned order. The trigger for these proceedings is a legal event that is not usually within the control of the trademark owner i.e. it is the alleged infringer or opponent who sets in motion the events leading to the proceedings that can result in a trademark being declared ‘well known’. The new Rule 124 allows the trademark owner to set the ball rolling without requiring any infringement or opposition proceedings. The rule does impose some vague duty to “invite objections from the general public” but this process is fundamentally different from opposition, rectification or infringement proceedings where an opposing party has already asserted its rights against the trademark owner.

The crucial question at this juncture is whether Rule 124 is constitutional? Rules, which are delegated legislation, draw their legitimacy from the parent statute. In this case the Trade Mark Rules, 2017 draw their legitimacy from the Trade Marks Act, 1999. This legislation however does not delegate to the Central Government the power to create an entirely new procedure to recognize well known trademarks. Section 157 of the Act which lays out the rule making power of the Central Government under the Trade Marks Act, 1999 is silent on the issue of well known trademarks. There is a residuary provision in Section 157(xli) that gives the Central Government the power to make rules for “any other matter which is required to be or may be prescribed”. Like all provisions conferring residuary powers, this provision is widely drafted however a residuary provision is still bound by the two most important principles of delegating legislative power: The first principle is that delegated legislation cannot be in conflict with the provisions of the parent legislation. Secondly, an essential legislative function cannot be delegated by Parliament to the Executive – the In re Delhi Lawsjudgment is quite clear on this issue. The new Rule 124, I would argue, goes against both principles. The rule reflects an entirely new policy to recognize “well-known” trademarks through a procedure that is not an adversarial proceeding (as is the case currently). In fact, the new procedure is in conflict with the adversarial procedure recognized in Section 11 for a trademark to be recognized as well known. Unlike the Section 11 procedure which required an opposition, rectification or infringement proceeding to trigger a adjudication on whether the trademark is well-known, Rule 124 allow a trademark to be recognized as well known by simply making an application to the Registry. The requirement to “invite objection” is fundamentally different from an opposition or rectification hearing because it does not guarantee a right to be heard. This entire procedure is alien to the scheme of the Trade Marks Act, 1999.

The true fear with this new procedure is that it places immense powers in the hands of the Trade Mark Registry, which as we all know is one of the more corrupt agencies in the IPO – we are all aware of Registrar’s Kasturi’s arrest and conviction on charges of corruption. The possibility for abuse of power is ably aided by some rather strange provisions in the Trade Marks Act, 1999. In particular Section 11(9) of the Trade Marks Act makes it clear that the Registrar shall not require as a condition, for determining whether a trade is well-known, any of the following, namely: (i) That the TM has been used in India; (ii) That the TM has been registered; (iii) that the application for registration of the trade mark has been filed in India; (iv) that the trade mark is well known in or registered in any other jurisdiction other than India (v) that the trademark is well-known to the public at large in India. Why should a trade mark be recognized as ‘well known’ in India if it not well known to the public at large? Isn’t that the entire point of being a ‘well-known’ trademark? Even the affirmative criteria to recognize a trademark as a ‘well-known’ trademark in Section 11(6)(i) goes against the very idea of a ‘well known’ trademark. This provision reads as follows “the knowledge or recognition of that trade mark in the relevant section of the public including knowledge in India obtained as a result of promotion of the trade mark”. Why should the trademark be recognizable only in the “relevant section of the public”? The entire point of granting “well known” trademark such vast protection is that it has attained recognition amongst a large section of the public not just a “relevant section of the public”. These provisions of the Trade Mark Act read like they have been written by a lobbyist and are begging to be amended.

NEW DELHI: Dabur has taken rival Marico to the Delhi High Court for allegedly violating trademark and copyright laws by comparing their hair oil products and denigrating its Dabur Amla in a print advertisement.

“It is a case of trademark infringement as well as disparagement of Dabur Amla,” said a person aware of the case. The court issued a notice to Marico and scheduled the next hearing for February 7, the person said.

Another person said Marico ran print ads last week that used pictures of Dabur Amla hair oil and compared it with its Nihar Shanti Amlahair oil.

Mumbai-based Marico’s consumer products include Parachute, Saffola, Nihar Naturals, Livon, Set Wet, Mediker and Revive. Dabur has a portfolio of over 250 herbal and ayurvedic products. A Dabur spokesperson declined to comment, saying the case is sub judice. A Marico spokesperson said its ad did not disparage the rival’s product in any manner.

“While the matter in question is sub judice, Marico is legally compliant with all its product advertisements and strongly believes in responsible communication,” a Marico spokesperson said in an emailed response. “In this particular case too, the advertisement factually represents the benefits of our product without disparaging the goodwill of another brand. We also have an acknowledgment on the same from the Advertising Standards Council of India.”

Metro Shoes has filed a case in the Bombay High Court alleging Flipkart is selling a private brand named Metronaut that is deceptively similar to Metro’s eponymous brand, and also alleged that the online retailer is selling shoes among other products under the brand name.

Piyush Shah, the lawyer representing Metro, said he has filed the case on Tuesday. “They are using the name of Metronaut that is similar to Metro,” Shah said. “It is a trademark infringement case.”

“Flipkart has not been aware of any such legal proceeding. If we are served notice by any court or judicial authority, we will take the necessary actions that are in the best interests of the company,” a Flipkart spokesperson said in an emailed response.

Late last year, Flipkart had launched products under Metronaut private label in men’s fashion and accessories. Currently, Flipkart sells denims, t-shirts, shirts, shoes and accessories such as belts, wallets and sunglasses under the Met .Metro operates over 200 outlets in and around 100 cities and also sells through other multi-brand stores.

BHOPAL: An additional session’s judge (ADJ) of Bhopal district court in Madhya Pradesh has summoned Facebookfounder and CEO – Mark Zuckerberg, to his court following a petition by a Bhopal based start-up alleging harassment.

Additional sessions judge Parth Shankar Mishra issued the order with directions to send the summons by email. He was hearing a civil suit filed by Swapnil Rai who runs a portal thetradebook.org, which he claims is a business networking platform.

Rai has alleged that Facebook had stopped his paid advertisement campaign to promote his ‘thetradebook’ page after running it for three days and then issued a legal notice opposing title of his portal. The campaign was run between August 8 to 14 2016 and second one was scheduled to be run between April 14 to 21, 2018.

“Second campaign was stopped wrongfully on April 16 for which a payment of Rs 215 was raised by Facebook. In the second ad-campaign there was promotion of the webpage www.thetradebook.org containing registered trademark ‘tradefeed’,” he added.

“They want to remove word ‘BOOK’ from my portal and had been sending legal notices to me causing immense mental stress,” Rai adding Facebook had been opposing their trademark application under Class 42 and Class 38 (of the Trademark Filing Classification). Rai also alleged that FACEBOOK was pressurising him to withdraw the trademark application.

On April 2016, a Noida based law firm had issued legal notice of Rai on behalf of Facebook. “The trademark FACEBOOK of our client is inherently distinctive and has been used in priority by our client in India. The word FACEBOOK does not exist in common parlance in India prior to the adoption thereof by our client. Our client was the first to use and popularise the term ‘BOOK’ in connection with social networking services. By virtue of its extensive, continues and popular use, our client owns exclusive rights to the trademark FACEBOOK. Moreover on account of the extensive, worldwide and popular use of the trademark FACEBOOK, no unrelated entity has the right to make use of the identical mark for any goods and services” – reads the notice.

The concerned law firm was contacted for their comment on this issue, but they refused to speak.

As per new Goods and Service Tax Act,2017 , which is going to apply on 1st July 2017 , very surprising provision under the Act is 5% tax liability on the food products those have registered a trade mark under Trade Mark Act ,1999 . the purpose of the provision is to collect more tax those who are enjoying brand goodwill with premium value and collecting huge margin compared to the non – branded goods from the customers.

But the biggest controversy on this issue is one side Government of India trying to promote and secure IPR ( Intellectual Property Rights ) ata Lower level like “ MSME’s” other side this kind of provisions under the new act at GST clearly killing the I.P.R. of the MSME’s . effect of this provisions hits only the small and medium scale Entrepreneurs because big players are already paying the Tax and they don’t have any problem about this.

Another side a small and medium scale industry those have registered trademark unnecessary face the stroke of 5 % , the food industry is already on the edge of the cut through competition with the big and Multinational companies they are already paying the tax , they don’t have any effect through this provisions because they are already selling their goods with the present tax slab.

MSME’s having very small number of the resources, very less turnover they will not survive in the market competition with big industries. this provision of the GST clearly discouraging the MSMEs to protect and

develop their IPR’s like the trademark.

The Big and MNC’s will enjoy only the Intellectual Property Rights in India, that only help to indirectly initiate the Monopoly Business theory where big fish only sharp their Fins through GST where the small and medium just Cut their Fins and just swing in a small Pound like “ tadpole ” . this provision of the act is only developing a big gap between big and small. Being a trademark and IPR professional, a number of Traders, Manufacturers, and Trade Mark owner contacted us and request to withdraw all their Registered trademarks otherwise they have to out of

the game of IPR . Again the provision is it self-conflicted in term “ Registered Trade Mark” and “ Un-Registered trademark ” because the Registration of the Trade Mark Act,1999 approximate procedure time to get final registration is two- three years, is meanwhile of the process time , what this trade marks called “ Branded” or “ Non-branded ” ? this is the biggest question.

The provision on the Registered trademark food product 5% tax is clearly against the motive of the Govt. to promote MSME’s IPR ( Intellectual Property Right ) , being the cost conscious market the 5% is very difficult for the small and medium scale industries , in the food industries the business margin of the goods like tea , pulses, rice , wheat and flours etc is only 1-2 % only , in that condition the big players having rich sportswear , big ground like huge marketing network, media etc. but the small one having the local small ground where they can’t compete with the bigger one .

In short, the provision 5 % tax on the Registered Trade Mark goods under the provision of GST 2017 is itself killing the sprite of the small and medium scale industries to make capable of fighting with big and MNC’s in India though weapon of IPR . One side DIPP ( Department of Industrial Policy and Promotion ) and MSME trying to aware MSME to protect their IPR’s as weapons to fight with big competitors another side , they are trying to surrender their small business tools like their registered trade marks.

Rakesh Soni , Trade Mark and IPR Attorney

www.trademarkiso.com, 9425318625