Revised Definitions and Benefits for the MSMEs

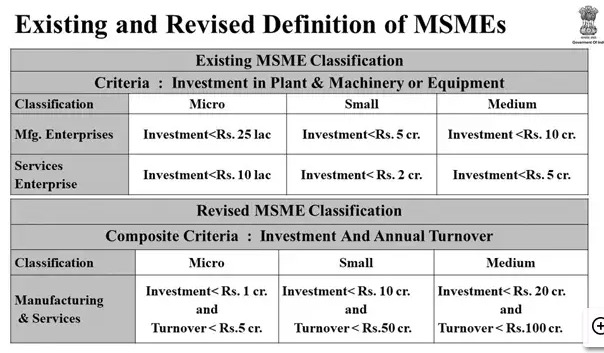

The Micro- Small and Medium Enterprises (MSMEs) are small sized entities, defined in terms of their size of investment. They are contributing significantly to output, employment export etc. in the economy. They perform a critical role in the economy by providing employment to a large number of unskilled and semi-skilled people, contributing to exports, raising manufacturing sector production and extending support to bigger industries by supplying raw material, basic goods, finished parts and components, etc. The existing MSME definition was based on the criteria of Investment in Pant Machinery or Equipment. However, our Hon’ble Finance Minister Nirmala Sitharaman announced a new definition for MSMEs. The composite criterion is now changed to Investment and Annual Turnover. The table for the revised definition of the MSMEs is provided below:

Benefits for MSME Registration

1. Bank Loans (Collateral Free)

The Government of India has made collateral-free credit available to all small and micro business sectors. This initiative guarantees funds to micro and small sector enterprises. Under this scheme, both the old as well as the new enterprises can claim the benefits. A trust named The Credit Guarantee Trust Fund Scheme was introduced by the GOI(Government Of India), SIDBI(Small Industries Development Bank Of India) and the Ministry of Micro, Small and Medium Enterprise to make sure this scheme is implemented (Credit Guarantee Scheme) for all Micro and Small Enterprise.

2. Subsidy on Patent Registration

A hefty 50% subsidy is given to the Enterprise that has the certificate of registration granted by MSME. This subsidy can be availed for patent registration by giving application to respective ministry.

3. Overdraft Interest Rate Exemption

Businesses or enterprises registered under MSME can avail a benefit of 1% on the Over Draft as mentioned in a scheme that differs from bank to bank.

4. Industrial Promotion Subsidy Eligibility

Enterprises registered under MSME are also eligible for a subsidy for Industrial Promotion as suggested by the Government.

5. Protection against Payments (Delayed Payments)

At times, the buyers of services or products from the MSME’s or SSIs tend to delay the payment. The Ministry of Micro, Small and Medium Enterprise lend a helping hand to such enterprises by giving them the right to collect interest on the payments that are delayed from the buyer’s side. The settlement of such disputes must be done in minimum time through conciliation and arbitration.

In case, if any MSME registered enterprise supplies any goods or services to a buyer then the buyer is required to make the payment on or before the agreed date of payment or within 15 days from the day they had accepted the goods and services from MSME or SCI registered business( if there is no mention of the date of payment).

If the buyer delays the payment for more than 45 days after accepting the products or services then the buyer has to pay compound interest along with interests (monthly) on the amount that was agreed to be paid. The interest rate is three times the rate that is notified by the Reserve Bank of India.

6. Reduction in Electricity Bills

This concession is available to all the Enterprises that have the MSME Registration Certificate by providing an application to the department of the electricity along with the certificate of registration by MSME.

7. ISO Certification Charges Reimbursement

The registered MSME enterprises can claim the reimbursement of the expenses that were spent for the ISO certification.

8. Priority Lending

Our first MSME benefit is priority lending. Whether you’re the proud owner of a cutting-edge technology business or a masala packing company, employing rural women, credit and loan is something that your business will inevitably require for long- and short-term financing. Banks, by virtue of the directions issued by the Reserve Bank of India, have certain earmarked funds that have to mandatorily be given to MSME businesses. Producing MSME certificate benefits to entitle one to avail this loan on a priority basis with fewer hassles.

9. Income Tax Exemption

There are several MSME registration benefits that can save lakhs of the amount that may be assessable to tax in the absence of this certificate. The benefit of a presumptive basis of taxation is available to enterprises, which relieves one from maintaining detailed books of accounts and undergoing audit procedures.

10. Technology and quality up-gradation support to MSMEs

In order to enhance the cost-effectiveness and promote clean energy use in manufacturing, the government reimburses project costs towards these goals for MSME sector units and also expenditure incurred for the implementation of clean technology, preparation of audit report and subsidies for licensing products according to national and international standards.

11. Exclusive purchases and sheltering from the competition:

As part of the MSME Market Development Assistance Scheme, the Central Government follows a Price and Purchase Preference policy. Wherein more than 358 items are listed under it for exclusive purchases by Central Government from the medium, micro and small units only.

12. Market assistance from the government and Export Promotion

The Government of India organizes several exchange programs, craft fairs, exhibitions, and trade-related events internationally. Being categorized as a micro, small or medium enterprise gives access to all of these platforms for international cooperation on trade-related aspects with different countries and fosters new business connections. The government also incentivizes the export of goods and services by MSMEs by way of subsidies, tax exemption, and technical support.

13. Credit Linked Guarantee Scheme

The Ministry of Micro, Small and Medium Enterprises and the Small Industries Development Bank of India (SIDBI) have established a Trust named Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) specifically to implement Credit Guarantee Fund Scheme for micro and small enterprises. This scheme allows collateral-free loans of up to 50 lakhs for individual MSMEs.

14. Goods and Services Tax

Several indirect tax reforms have been proposed to improve compliances such as a simplification of GST returns, automation of GST Refund, introduction of electronic invoice to facilitate compliance and return filing, Aadhaar based verification of taxpayers to weed out dummy or non-existent units, usage of deep data analytics and AI tools to crackdown GST input tax credit, refund, and other frauds. GST rate structure is also being deliberated so as to address issues like inverted duty structure.

Rs. 20 Lakhs Crore Package and the MSMEs

Big Boost to the MSME sector in sync with the Atmanirbhar Bharat announcement. The package provides more liquidity to MSMEs, raises the bar for investment and turnover and removes the distinction between the manufacturing sector and the service sector. This is further strengthened by the boost given to NBFCs/housing finance companies and microfinance institutions wherein they have been permitted to buy debt payable documents under full guarantee from the Government of India. As a result, it will not only provide liquidity but generate jobs and enable the journey towards realisation of atmanirbhar bharat motto. Further, with doing away from the global tender route, these MSMEs will also be able to work on contracts upto Rs 200 crore which earlier was not within their domain due to technicalities.

6 Measures and ‘AATMANIRBHAR’ MSMEs

- Credit and Finance for MSMEs:Out of the 15 relief measures announced by the Finance Minister Nirmal Sitharaman on Wednesday under the mega Rs 20 lakh crore stimulus package for the Covid-battered economy, six aimed at bringing lockdown-hit India’s vast MSME sector back to life. MSMEs across sectors and industries have been clamouring for a financial package from the government ever since the lockdown came into force on March 25. Sitharaman sharing the details of the humongous Covid-19 financial package – roughly 10 per cent of the Indian GDP – announced measures to boost liquidity in MSMEs, help them take benefit of the government schemes, enable them to compete with foreign companies, and strengthen their network.

- Rs 3 lakh crore collateral-free loans: Banks and NBFCs will offer up to 20 per cent of entire outstanding credit as on February 29, 2020, to MSMEs. Units with upto Rs 25 crore outstanding credit and Rs 100 crore turnover are eligible for taking these loans that will have four-year tenor with a moratorium of 12 months on principal payment. The scheme can be availed till October 31, 2020. The government will provide complete credit guarantee cover to lenders on principal and interest amount.

- Rs 20,000 crore subordinate debt: MSMEs declared NPAs or those stressed will be eligible for equity support as the government will facilitate the provision of Rs 20,000 crore as subordinate debt. The government will also provide Rs 4,000 crore to CGTMSE that will offer partial credit guarantee support to banks for lending to MSMEs.

- Rs 50,000 crore equity infusion: The government will infuse Rs 50,000 in equity in MSMEs through a Fund of Funds that will be operated through a Mother fund and a few daughter fund. The Fund of Funds will be set-up with a corpus of Rs 10,000 crore to give equity-based funding to MSMEs having growth potential and viability. It will also urge MSMEs to list on stock exchanges.

- Revised MSME definition: To address MSMEs fear of outgrowing in size to receive benefits given by the government to businesses categorized as per the current MSME definition, Nirmala Sitharaman on Wednesday revised the definition. Under the new definition, manufacturing and service MSMEs will be defined under a common metric that will be a mix of investment in plants and machinery or equipment and turnover.

- Global tenders disallowed: Addressing MSMEs’ issue of unfair competition from foreign companies in government procurement tenders due to the size and strength differ, the government said it will not allow global tenders in such schemes upto Rs 200 crore. Necessary amendments of General Financial Rules will be effected, according to the government document detailing the 15 relief schemes.

- Clearing MSME Dues: Our Hon’ble Finance Minister Nirmala Sitharaman said that the government and central public sector enterprises will release all pending MSME payments in 45 days. The minister also said that fintech enterprises will be used to boost transaction-based lending using the data by the e-marketplace. This e-market for developing linkages for MSMEs will be promoted to replace trade fairs and exhibitions.